Economic Growth and Development in 11 cities in the Greater Bay Area, 2016-2020

Policy Brief

RECEPD No. 2023 – 001

August 2023

This policy brief is a collaborative effort based on data analysis and research discussion among the following researchers affiliated with the Research Consortium on Education Policy and Development in the Greater Bay Area (RECEPD), HKIER:

Dr. Dongshu OU

Dr. Yan CAO

Dr. Kenneth K. WONG

Ms. Maggie FOK

The Greater Bay Area (GBA) in southern China covers two special administrative regions (Hong Kong and Macau) and nine cities of Guangdong province. It is one of the most dynamic and fastest growing regions in China. The Research Consortium on Education Policy and Development in Greater Bay Area of HKIER (RECEPD)conducted a series of data analysis to understand the region’s economic development, education, and population migration. For this policy brief on economic development, we collected and analyzed statistics from yearbooks of 9 GBA cities in mainland China, as well as World Bank data and official statistics released in Hong Kong and Macau.

The development plan for the GBA was released by the Chinese central government in 2019, with a vision to build an integrated economic area that leverages the strengths and complementarities of each city. The plan sets out several key goals for the GBA by 2035: 1) developing a modern innovation-driven industrial system; 2) Promoting innovation and entrepreneurship; 3) Strengthening infrastructure and connectivity; 4) Enhancing the quality of life for residents in the region. The GBA is expected to play a key role in China’s economic growth in the coming years by creating new opportunities for trade, investment, talent attraction, and technological advancement. The GDP of GBA is expected to exceed other Bay areas in the world such as San Francisco Bay Area, and the Greater Tokyo Bay.

According to the World Bank, HK Census and Statistics Department, and Macau Statistics and Census Service in 2020, the Gross Domestic Product (GDP) of Greater Bay Area is as high as USD 1672 billion), which accounts for 11.1% of the combined GDP of Mainland China (USD 14,727 billion), Hong Kong (USD 350 billion) and Macau (USD 24 billion).

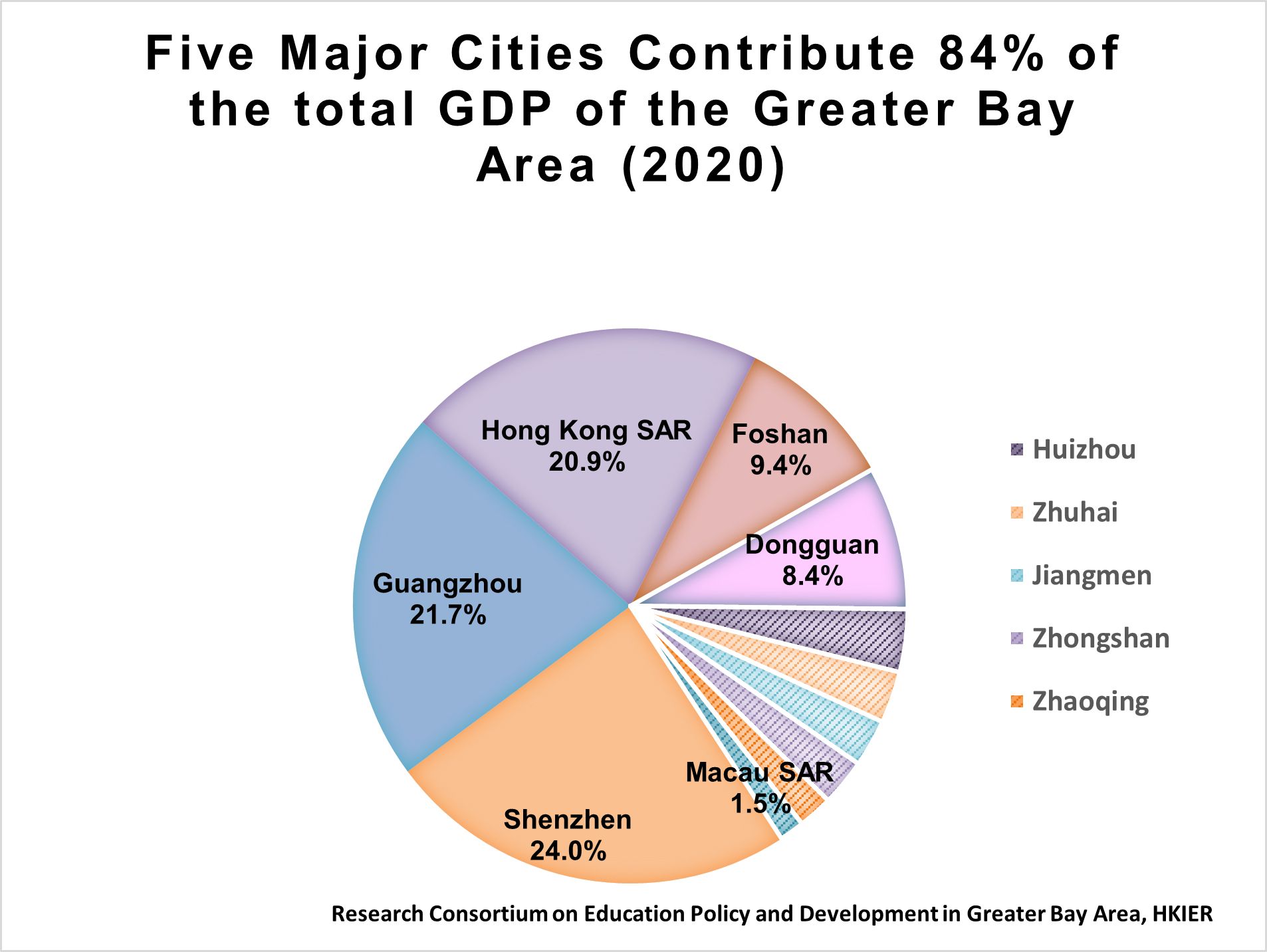

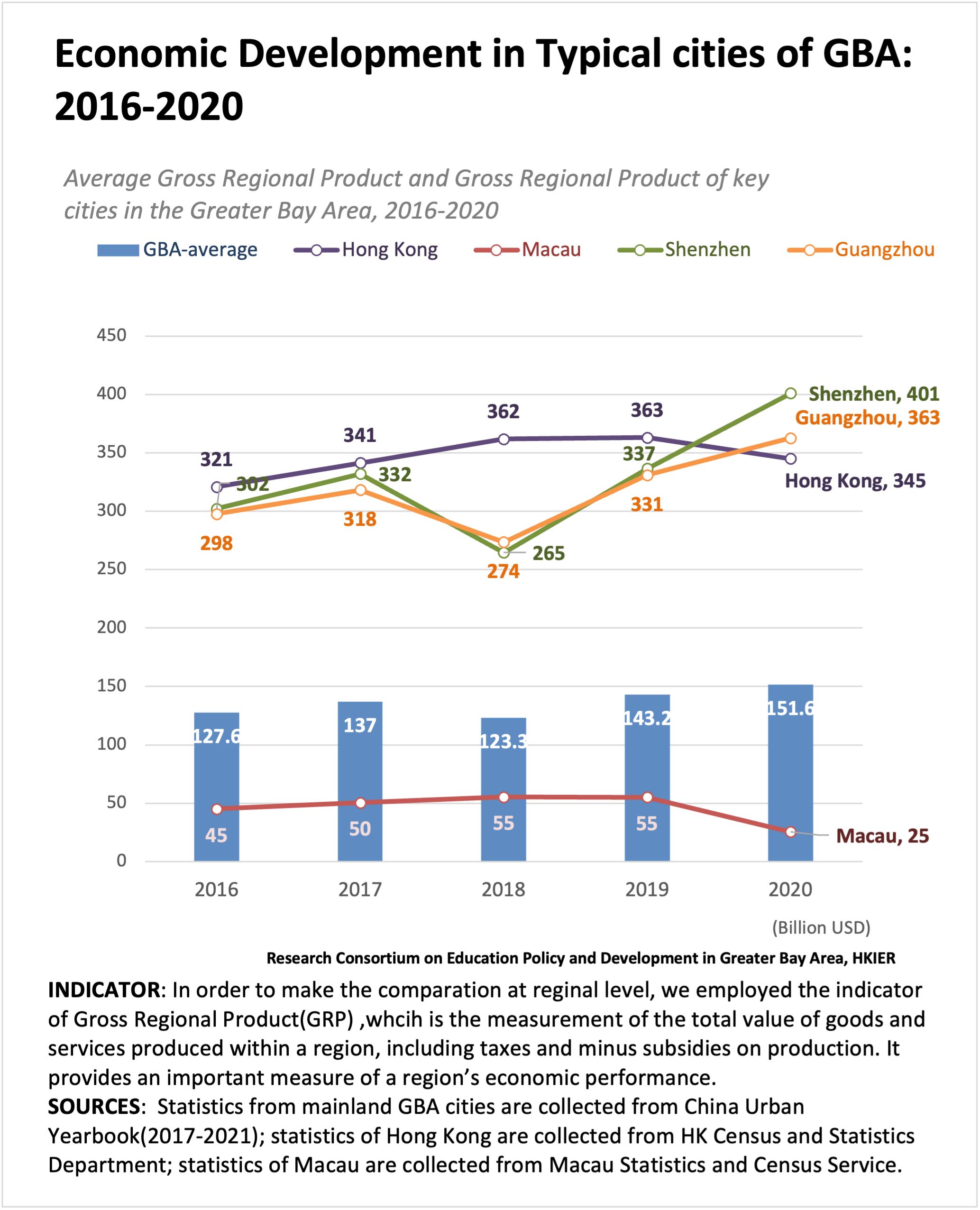

The contribution of different cities to the economic development of the Guangdong-Hong Kong-Macao Greater Bay Area varies considerably. According to the 2020 data, five main cities, including Shenzhen, Guangzhou, Hong Kong, Foshan, and Dongguan, contributed 84% of the overall GDP. The other 6 cities, including Macau, Huizhou, Zhuhai, Jiangmen, Zhongshan, and Zhaoqing accounted for less than 15% of the total GDP. Macau, hit hardest by the COVID-19 pandemic, accounted for only 1.5% of the total GDP in 2020.

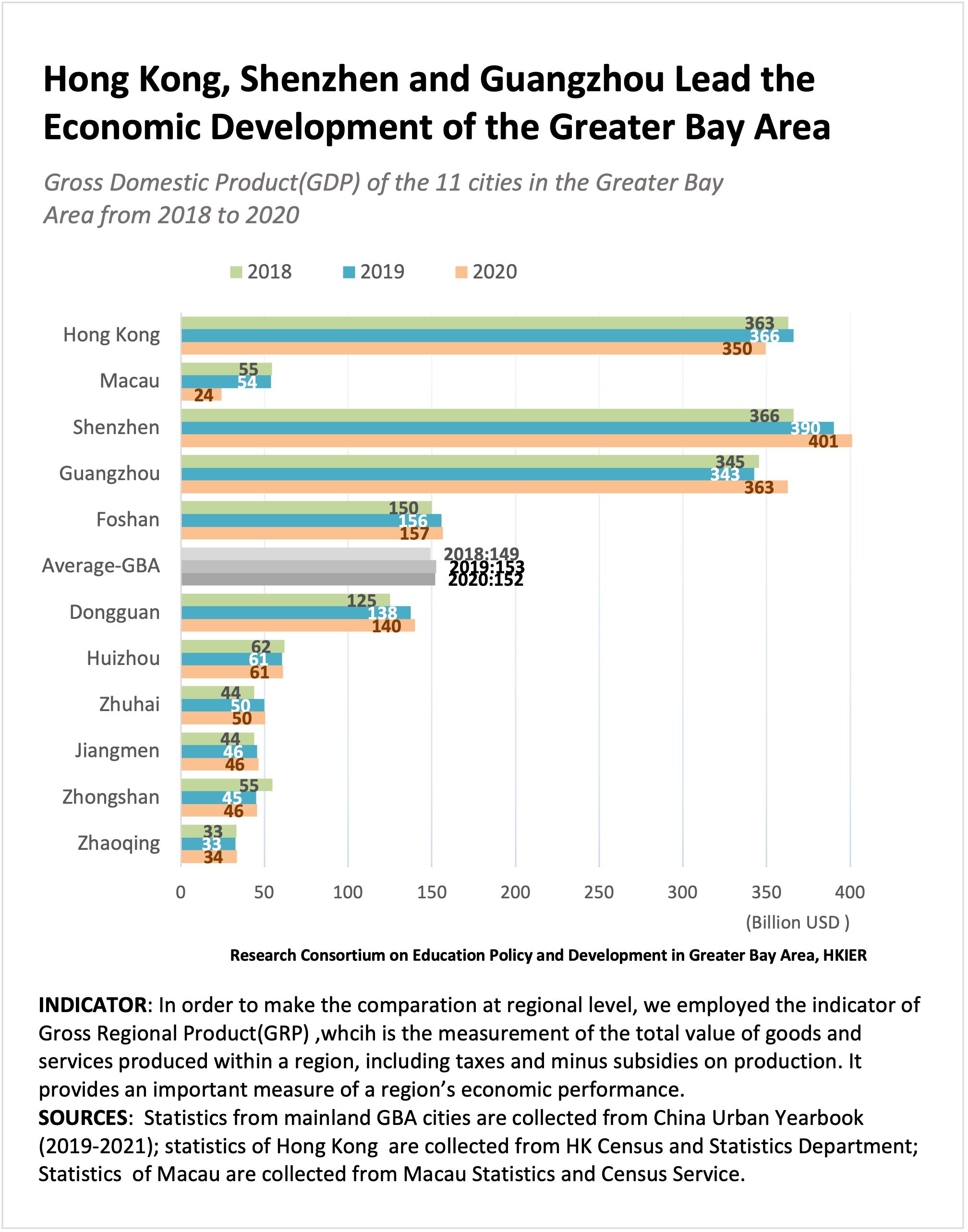

Between 2018 and 2020, a period after the release of the 13th Five-Year Plan (FYP) in March 2017 and the first year of the pandemic, the GDP output value of the Greater Bay Area transitioned from a steady increase to a marginal decline. The total output value registered at USD 1,791.4 billion in 2018, escalated to USD 1,832.4 billion in 2019 (a growth rate of 2.3%), and experienced a slight downturn to USD 1,823.7 billion in 2020, with a decrease of 0.4% compared to 2019. The mean figures for the 11 cities during the 2018-2020 period were USD149 billion, USD153 billion, and USD152 billion respectively.

In terms of jurisdictional diversity, the Greater Bay Area exhibits considerable economic development heterogeneity. Hong Kong, Shenzhen, and Guangzhou- three of the world’s top ten ports – hold leading positions, followed by Foshan and Dongguan in the intermediate tier across the 11 cities. Huizhou, Macau, Zhuhai, Jiangmen, Zhongshan, and Zhaoqing are situated within the middle to lower tier of the Greater Bay Area, with their economic scales approximating one-tenth to one-fifth of those of Hong Kong, Shenzhen, and Guangzhou.

The impact of the COVID-19 pandemic on Hong Kong and Macau was notably evident. Hong Kong’s GDP output value experienced a decrease of less than 5%, while Macau’s GDP was significantly affected, with the GDP output value dropping by 1.2 times.

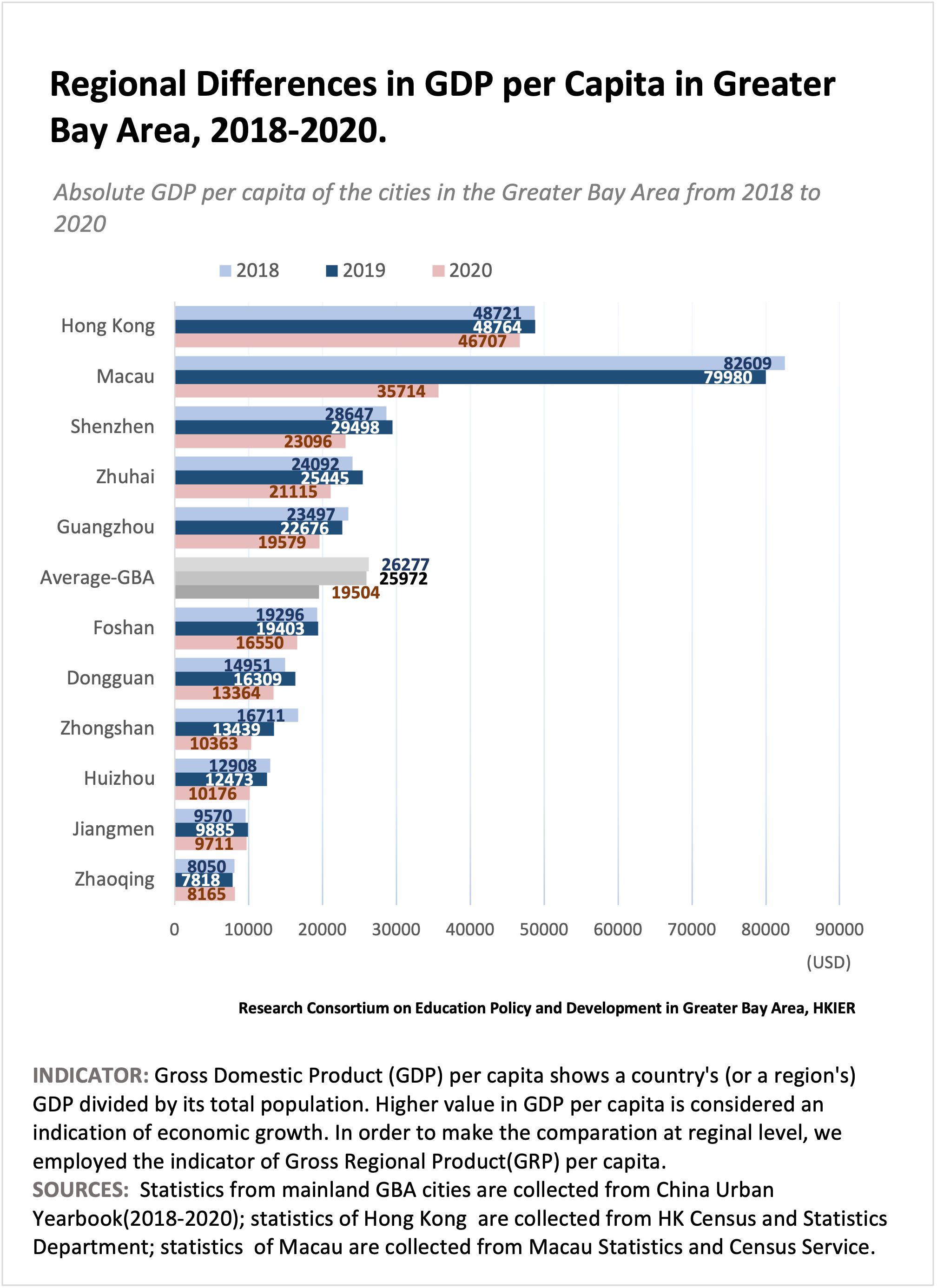

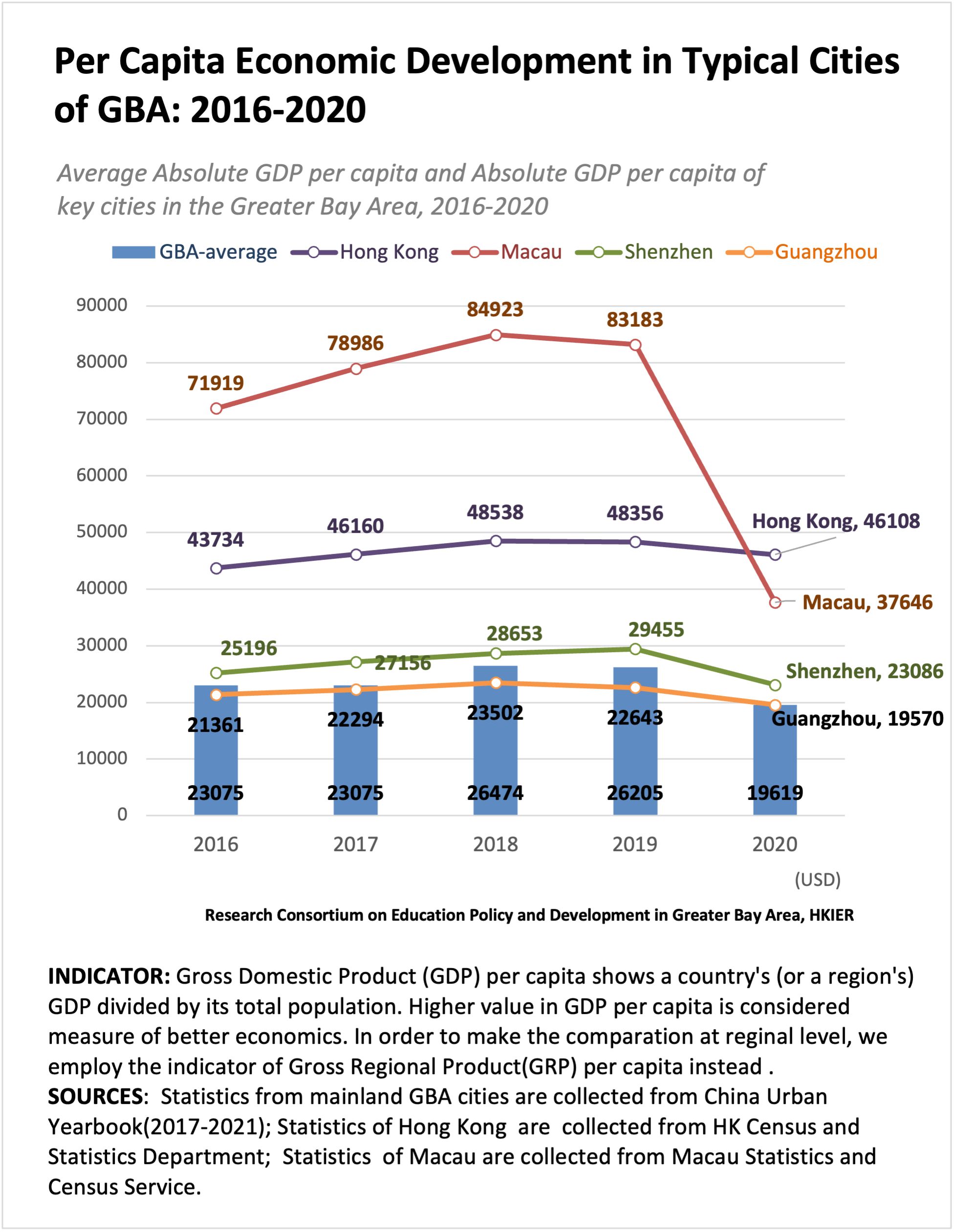

Considering the population in each jurisdiction, Macau became the number 1 city in terms of GDP per capita before 2020, with a GDP per capita income approaching USD 80,000. It was followed by Hong Kong and Shenzhen, Zhuhai, and Guangzhou, with GDP per capita of USD 48,000, USD 29,000, USD 25,000, and USD 22,000 USD respectively.

Between 2018 and 2020, the average GDP per capita for the 11 cities exhibited a gradual decline: USD 26,277 in 2018, USD 25,071 in 2019, and USD 19,503 in 2020. However, the 2020 pandemic had the most profound impact on Macau, causing its GDP per capita to plummet sharply (by more than 50%). Conversely, Hong Kong maintained a similar level of GDP per capita in 2020. All other cities in the GBA experienced decline in their GDP per capita in 2020, except for Zhaoqing, which ranked lowest in GDP per capita among all GBA cities. The disparity between the highest and lowest GDP per capita was substantial. Prior to the pandemic, the difference in GDP per capita between Macau, the city with the highest GDP, and Zhaoqing exceeded 10 times, with gaps of USD 74,559 in 2018 and USD 72,162 in 2019. During the pandemic, the GDP per capita of Hong Kong, the city with the highest GDP, was 5.72 times greater than that of Zhaoqing, with a monetary difference amounting to USD 36,996.

Variations and changes in GDP per capita might reflect the different industry distributions in each city. For example, Zhaoqing has the highest percentage in agricultural industry (19%), which could explain in part its lowest GDP level in GBA as well as the lowest degree of impact by the pandemic in its economy.

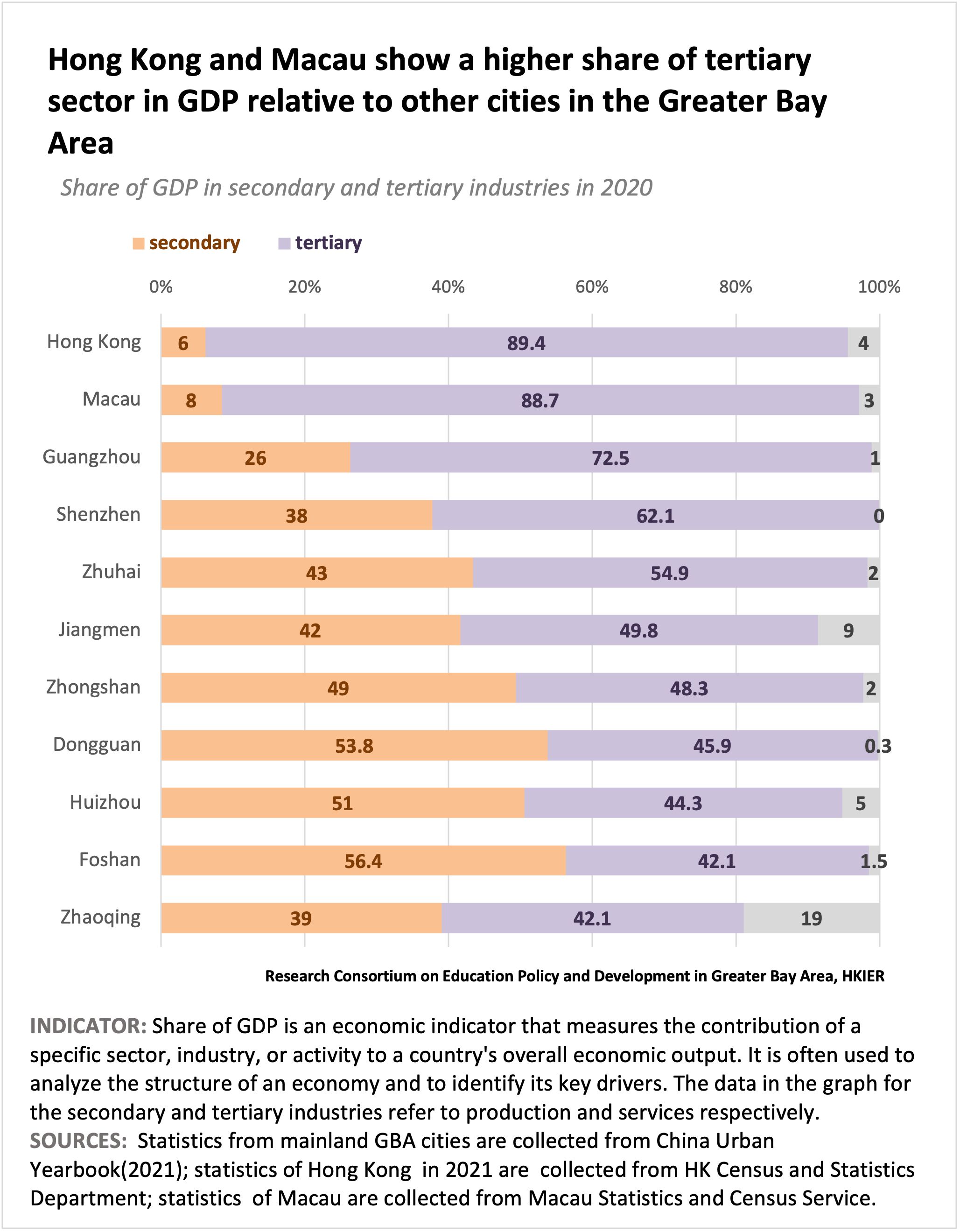

Cities ranked top in the GDP per capita have the largest share of the tertiary industry in their economy, these include Hong Kong (89.4%), Macau (88.7%), Guangzhou (72.5%), and Shenzhen (62.1%). For Macau, the gaming industry plays a crucial role as a major source of government revenue and a significant employer in the city (Macau Statistics and Census Service, 2020). In 2019, the gaming industry accounted for 51% of the Macau’s total GDP and provided jobs for around 83,000 people. Due to several restrictions of pandemic, the number of tourists visiting Macau was reduced significantly, causing a sharp decline in the gaming industry’s revenue. In 2020, the city’s gaming revenue plummeted by 81.2% compared to the previous year, marking the most considerable drop in its history.

Foshan, Dongguan, Huizhou, and Zhongshan, among the 11 cities, undertake the main manufacturing-related functions, with manufacturing contributing to about 50% of the GDP. According to the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) strategies, cities like Foshan, Dongguan, Huizhou and Zhoushan have been designated to focus on manufacturing, while cities like Hong Kong, Macau, Guangzhou and Shenzhen mainly concentrate on innovation, technology, and the service industry. Consequently, a gradual shift of the relative importance of different industries has emerged, resulting in a decrease in the manufacturing sector’s share. For example, in Shenzhen, the share of the manufacturing sector decreases from 41.1% in 2018 to 38% in 2020. At the same time, the contribution of the tertiary industry has been increasing in Shenzhen, whose share of the tertiary industry increased from 58.8% in 2018 to 62% in 2020.

Considering the timeline of the relevant policies in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA), the regional average GDP has increased following the implementation of GBA policies from 2016 to 2020. It rose from USD 127 to USD 137 billion in 2016 and 2017 to USD 151.6 billion in 2020. The economic growth paths look similar in Shenzhen and Guangzhou where there was a sharp increase. Hong Kong and Macau have experienced a similar steady level of increase before 2019 but a decline in 2020 due to the pandemic. The decline in GDP per capita growth is the largest for Macau during the pandemic.

Policy Implications

This policy brief reveals the varying levels of economic development and differences in sectoral structures among cities in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA). Hong Kong, Shenzhen, and Guangzhou contribute to a significant proportion of the region’s economic growth. At the same time, Dongguan and Foshan, relying on the continuous development of the manufacturing industry and demonstrate rapid growth rates, provide critical and essential manufacturing support for the service-driven economies of Hong Kong, Shenzhen, and Guangzhou. Huizhou, Zhaoqing, and Jiangmen are cities within the GBA that lag in terms of economic development. These cities contribute relatively less to the region’s economy and may face challenges such as talent outflow and a lack of public resources to support their education system. Issues of schooling quality, workforce development, and migration patterns in GBA are ongoing research topics for CECEPD at HKIER.